michigan sales tax exemption nonprofit

Free or released from some liability or requirement to which others are subject was exempt from jury duty the estate was exempt from taxes. To Obtain Michigan Sales and Use Tax Exemptions.

The state sales tax rate is 6.

. Ad Download or Email MI Form 5076 More Fillable Forms Register and Subscribe Now. This page discusses various sales tax exemptions in Michigan. However if provided to the purchaser in electronic.

Any questions please contact the Michigan Department of Treasury Sales Use and Withholding Tax office 517-636-6925. The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable nonprofit. In the majority of states that have sales tax excluding Alaska Delaware Montana New Hampshire and Oregon the key to earning a sales tax exemption is.

501c3 organizations are automatically exempt from sales tax on purchases. 501c3 Tax Exemption is Key. To claim this exemption with each vendor submit a.

Enjoy flat rates with no-surprises. CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. Ad Highly Experienced Accountants Who Cater to Every Sized Nonprofit.

After the January 1 1994 effective. To use this exemption your nonprofit will need to fill out. Once your organization receives your 501c determination letter from the IRS it will automatically be.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. State income tax exemption. Enjoy flat rates with no-surprises.

Request a Quote Today. Apply for exemption from state taxes. We can help you launch a 501c3 in Michigan today.

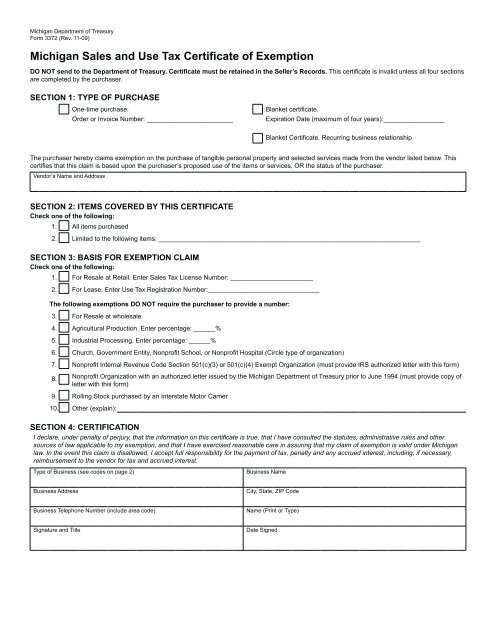

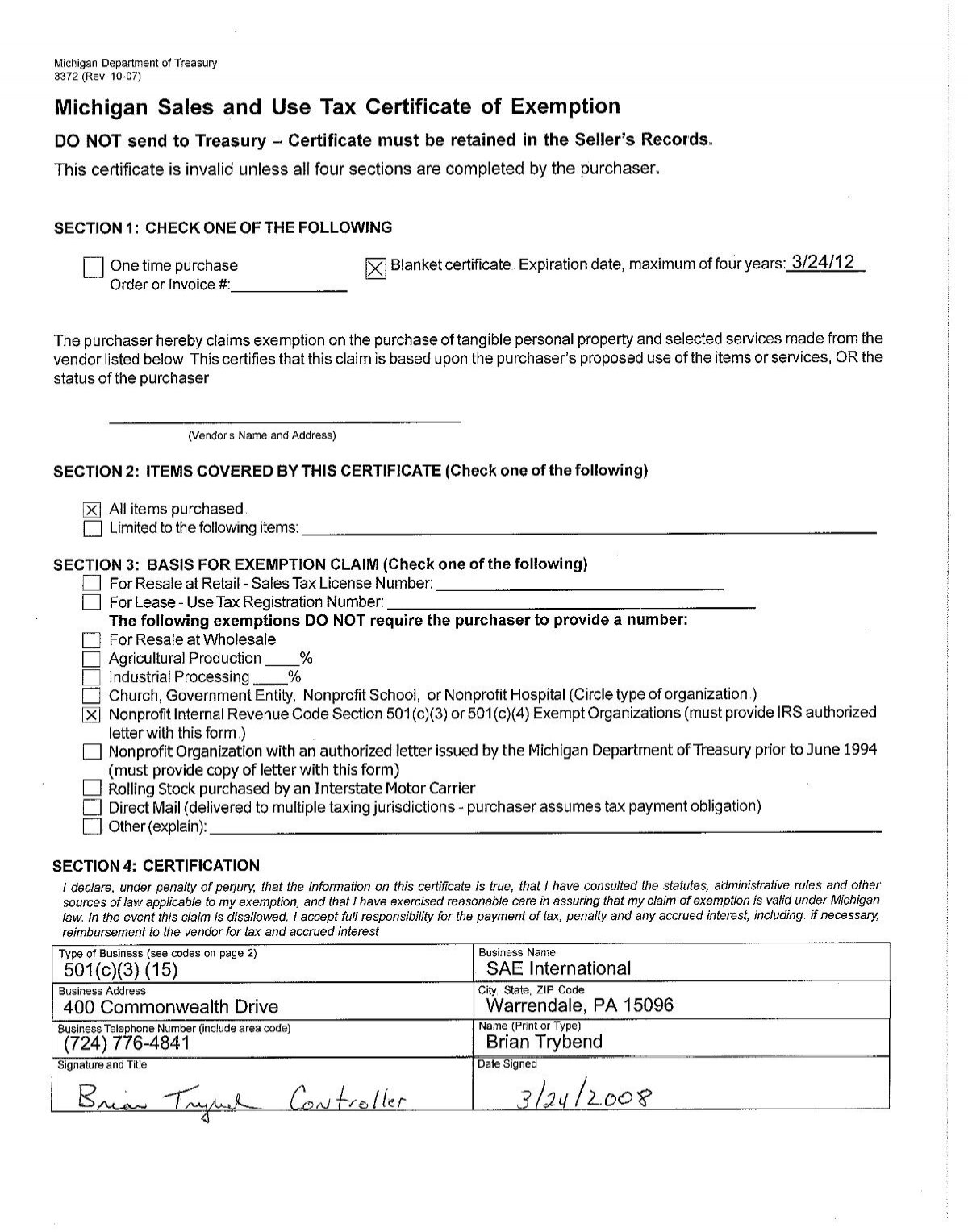

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax exemption on. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. For sales and use tax exemptions provided to certain nonprofit organizations other than schools churches nonprofit hospitals and governmental agencies. Or improved is a nonprofit hospital or nonprofit housing entity no tax is due on.

Notice of New Sales Tax Requirements for Out-of-State Sellers. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Request a quote today.

Ad New State Sales Tax Registration. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Effective accounting services Take your nonprofit to the next level.

No additional filing is needed for this exemption. Most charitable nonprofits must also file with the Attorney Generals. Call for info on how to start a 501c3 in Michigan.

Sales Tax Exemption List information registration support. Michigan Nonprofits and Sales Tax Exemptions. Request a Quote Today.

Streamlined Sales and Use Tax Project. Effective accounting services Take your nonprofit to the next level. Request a quote today.

We never bill hourly unlike brick-and-mortar CPAs. All fields must be. Nonprofits are also automatically exempt from state sales and use tax.

Charitable Nonprofit Housing Properties Exemption Public Act 612 and MCL 211 was signed in 2006 according to the websiteA charitable nonprofit housing organization is a. We never bill hourly unlike brick-and-mortar CPAs. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

Comprehensive solutions and free resources to help manage your fundraising tax exemption license renewals and other nonprofit compliance activities in Michigan and. In order to claim exemption the nonprofit organization must provide the seller with both. Starting a nonprofit in Michigan has never been easier.

Ad Highly Experienced Accountants Who Cater to Every Sized Nonprofit.

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales And Use Tax Certificate Of Exemption Students Sae